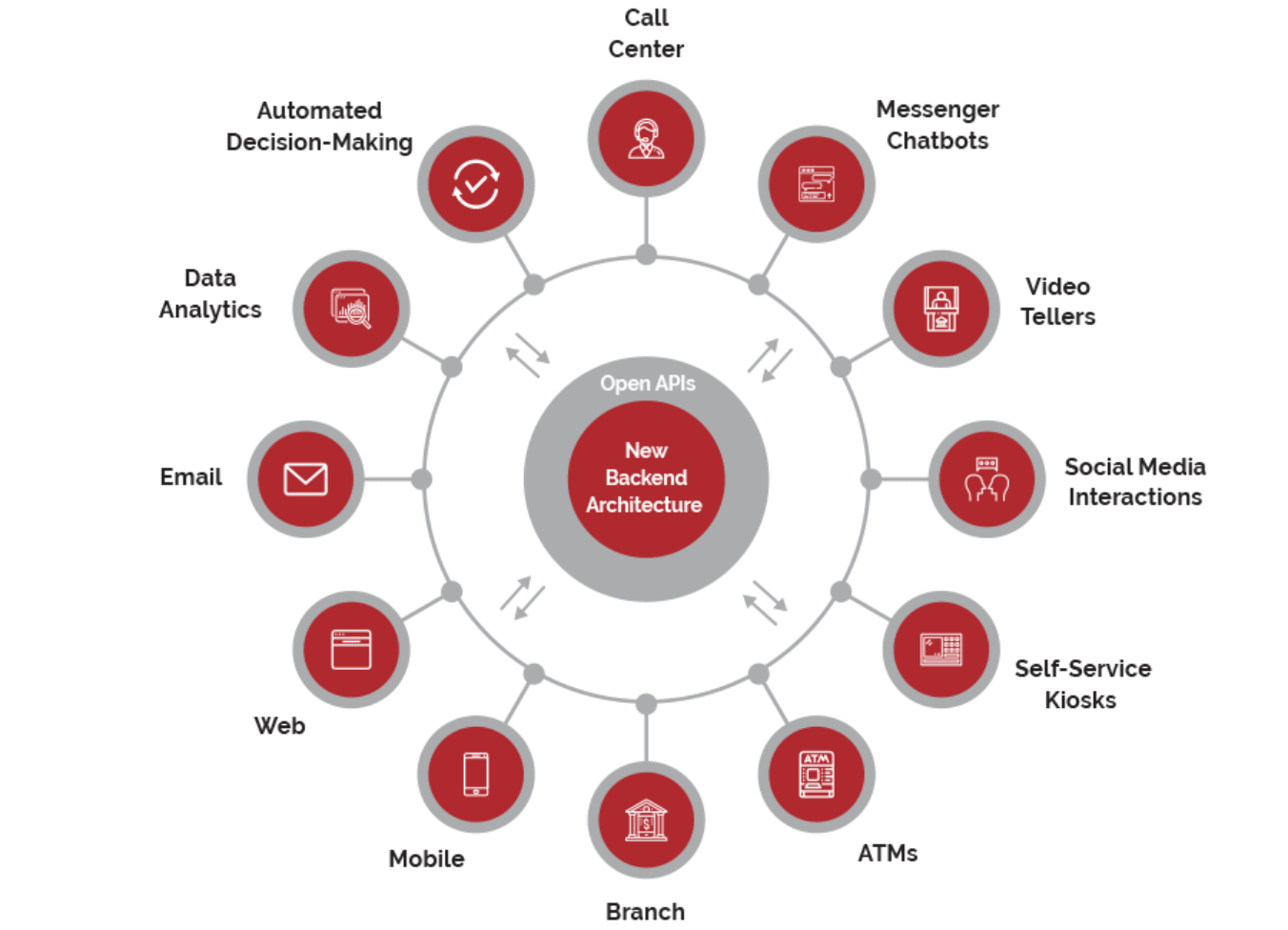

For today’s financial institutions to have the full control, flexibility, or scale they need to remain competitive, CNS’ Omni-Channel solution-platform enables banks and credit unions to accelerate innovation without compromising critical services.

-

Omni-Channel applications

-

Branch Transformation

Choose a great partner to enjoy the Multiple benefits of omni-channel digital solutions.

CNS will give you the full control, flexibility, and scale you need to remain competitive. Our Omni-Channel solution-platform enables banks and credit unions to accelerate innovation without compromising critical services.

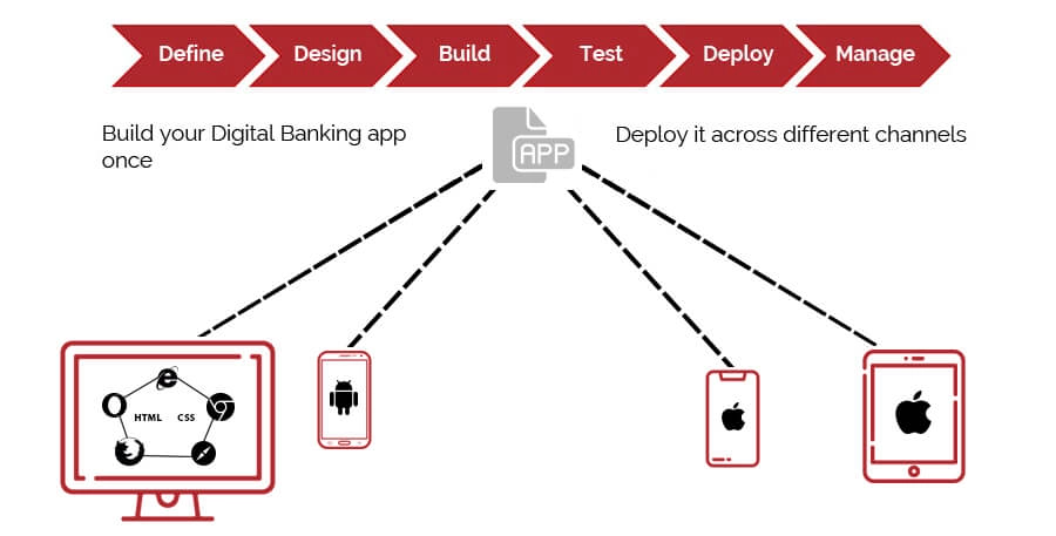

Traditional Approach - Multi-Channel App Development

Modern Approach - A Unified Application

Omni-channel – Multiple benefits

CNS will give you the full control, flexibility, and scale you need to remain competitive. Our Omni-Channel solution-platform enables banks and credit unions to accelerate innovation without compromising critical services.

Traditional Approach - Multi-Channel App Development

- Daunting

- Resources applied to each channel

- Efforts repeated for each channel

- Slow process

- Costly

Modern Approach - A Unified Application

Omni-channel – Multiple benefits

- Unified app development over all channels

- Aggregated services supporting multi-vendor integration

- Intelligence functions supported by analytics, machine learning & predictive modeling

- Extensibility for simpler upgrades

- Customized Marketing that adapts to customer needs

- Centralized and secure data storage

Transform your branch into the retail experience your customers want and need?

CNS will help you blend your physical and digital banking channels, and show you how to drive loyalty and deliver modern, innovative services that reduce costs and increase revenues to strengthen your competitive advantage and enhance your customer’s whole banking experience.

What We Offer

Remote Assistance Connect with a remote teller in a personalized, two-way audio/video interaction

Video Teller Offer assistance and support in real-time with visibility for trusted instructions

Multi-Function ATM Self Service ATMs on-premise to transform your branch into a multiple service offering

CNS has the banking experience to transform your bank into a digitally enhanced space for customers demanding more than just a place to look after their money.

CNS will help you blend your physical and digital banking channels, and show you how to drive loyalty and deliver modern, innovative services that reduce costs and increase revenues to strengthen your competitive advantage and enhance your customer’s whole banking experience.

What We Offer

Remote Assistance Connect with a remote teller in a personalized, two-way audio/video interaction

Video Teller Offer assistance and support in real-time with visibility for trusted instructions

Multi-Function ATM Self Service ATMs on-premise to transform your branch into a multiple service offering

CNS has the banking experience to transform your bank into a digitally enhanced space for customers demanding more than just a place to look after their money.

Increase in Revenue

- Tellers freed from repetitive transactions interact more with customers

- Innovations allow your branch staff to personalize offers to customer segments

- Add new self-service transactions offers to digital zones at will

- The ATM is a trusted, high-impact marketing channel, attracting new customers and upselling or cross-selling products to existing ones

Reduce Cost

- ATMs that deliver innovative customer services

- ATMs that offer more features and services so your tellers don’t have to

- Multiple, adaptable and scalable branch formats sized in terms of staff, location, and service needs

- Remote assistance lowers operational costs

Enhance Experience

- Easily brand the experience over the underlying ATM application or hardware

- Consumers can set their transaction type, contact, and product preferences

- Personalized experiences with video tellers and in-person tablet apps